Sustainable design is the act of embedding design into a business to the level where it remains a constant act and not an afterthought. Instead of using design as an aesthetic veneer created by a small group, you move to a model of design leadership used across an entire business. Your design teams will no longer be the gatekeepers of design, but the facilitators and mentors.

When you achieve this design becomes sustainable. It is seen not as a cost, but a way to achieve your vision.

The vision - move from gatekeepers to leaders.

At Vanquis the move to sustainable design has been a hard one. This was a business created and nurtured by rational people. The experiences they've had of designers had been marketing and creative agencies. In the 15 years they'd existed successfully as a business they'd only been exposed to the "crazy creative" side of design.

The job to be done was to build a high degree of trust and increase understanding of what design is so that we could move to a more strategic role.

By using rigorous and peer reviewed research, and through the generation of testable and actionable insights, we began the process of building trust in the full design process. We involved the wider business in our customer interviews, and we showed them how to generate personas that help guide product development. By keeping the business involved we avoided the majority of the awkward conversations that naturally occur when research findings disagree with common belief.

We found immediate opportunities in the application journey, issues with the mobile app, and gaps in customer support.

Our Inclusive Thinking audit

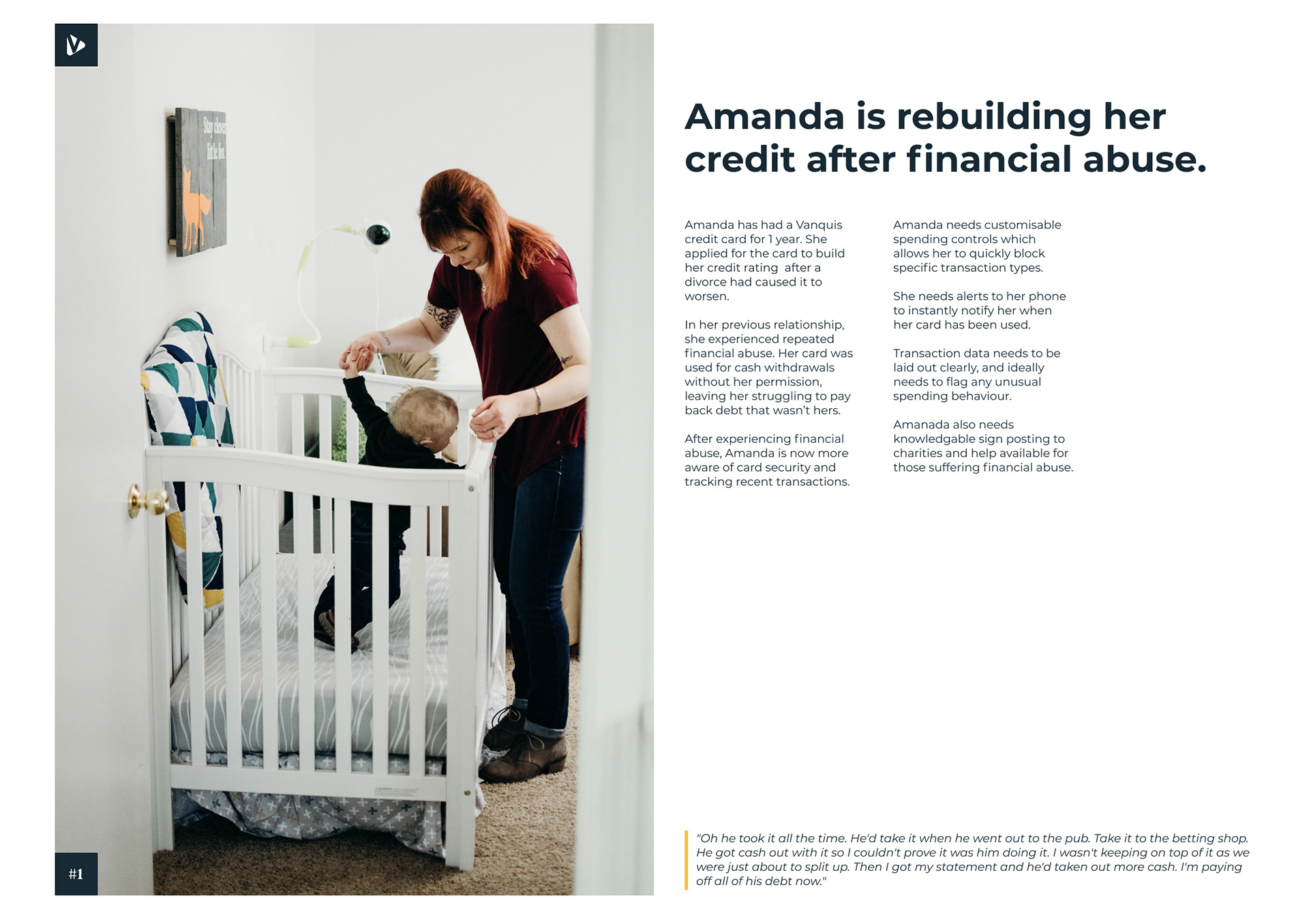

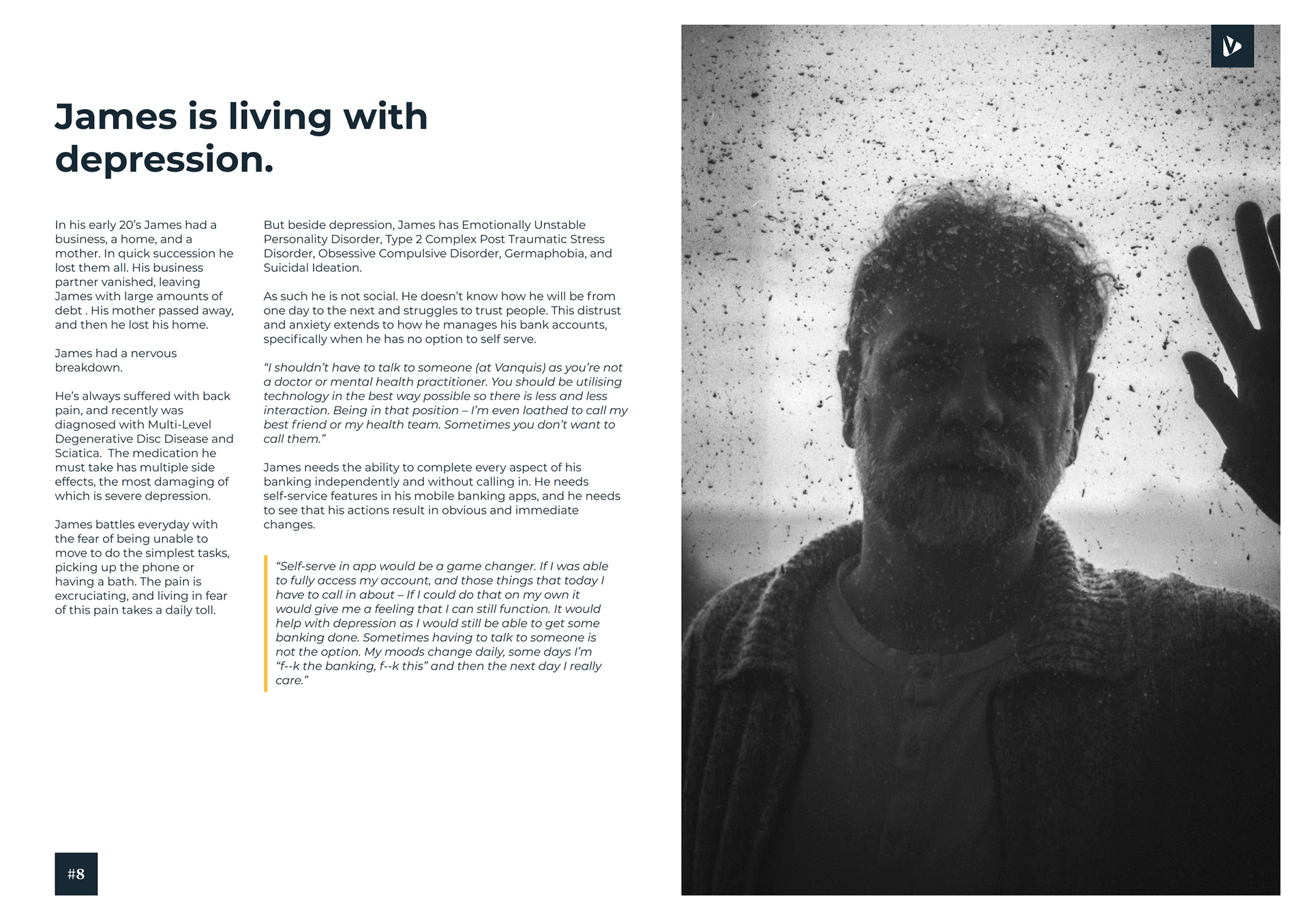

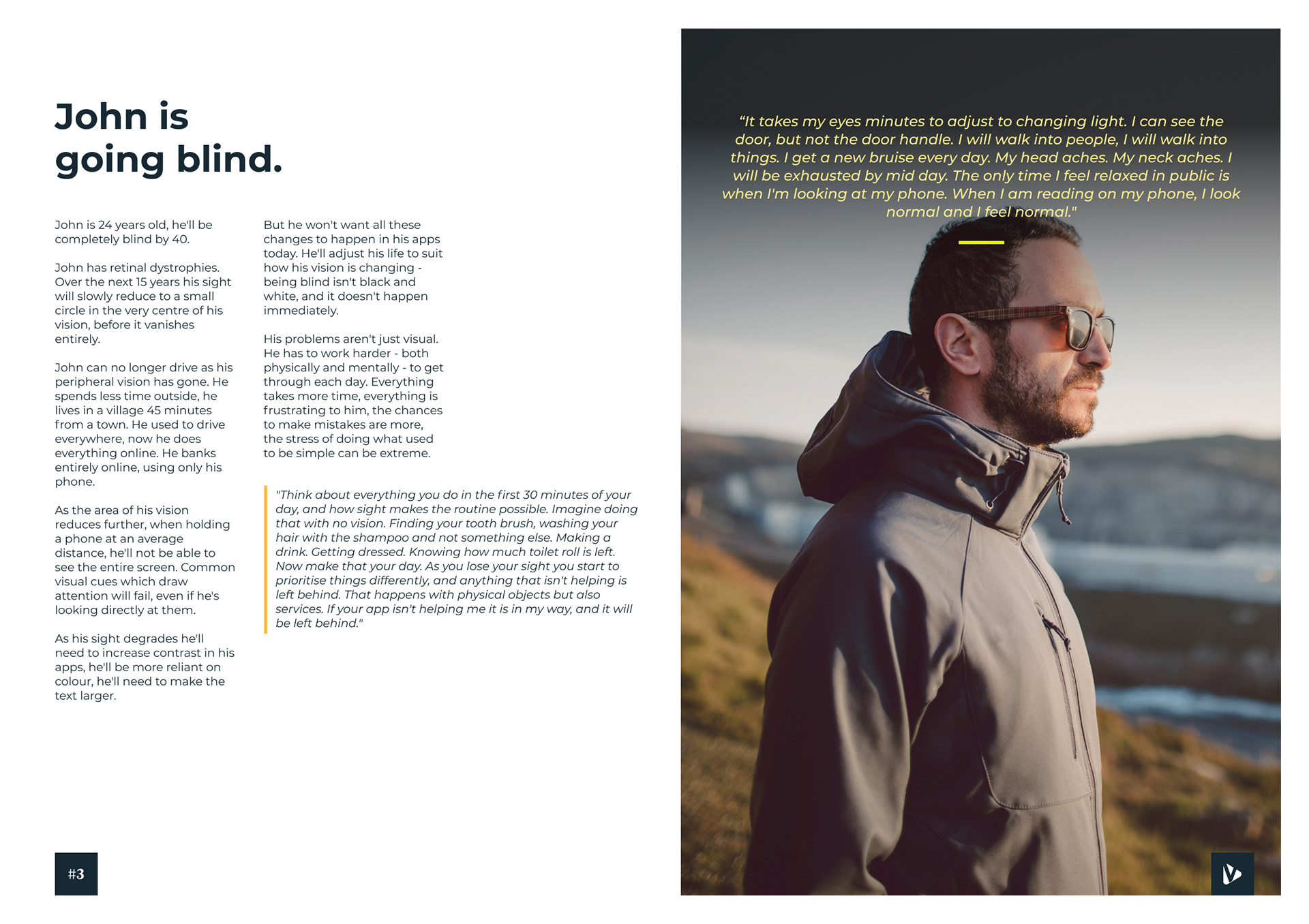

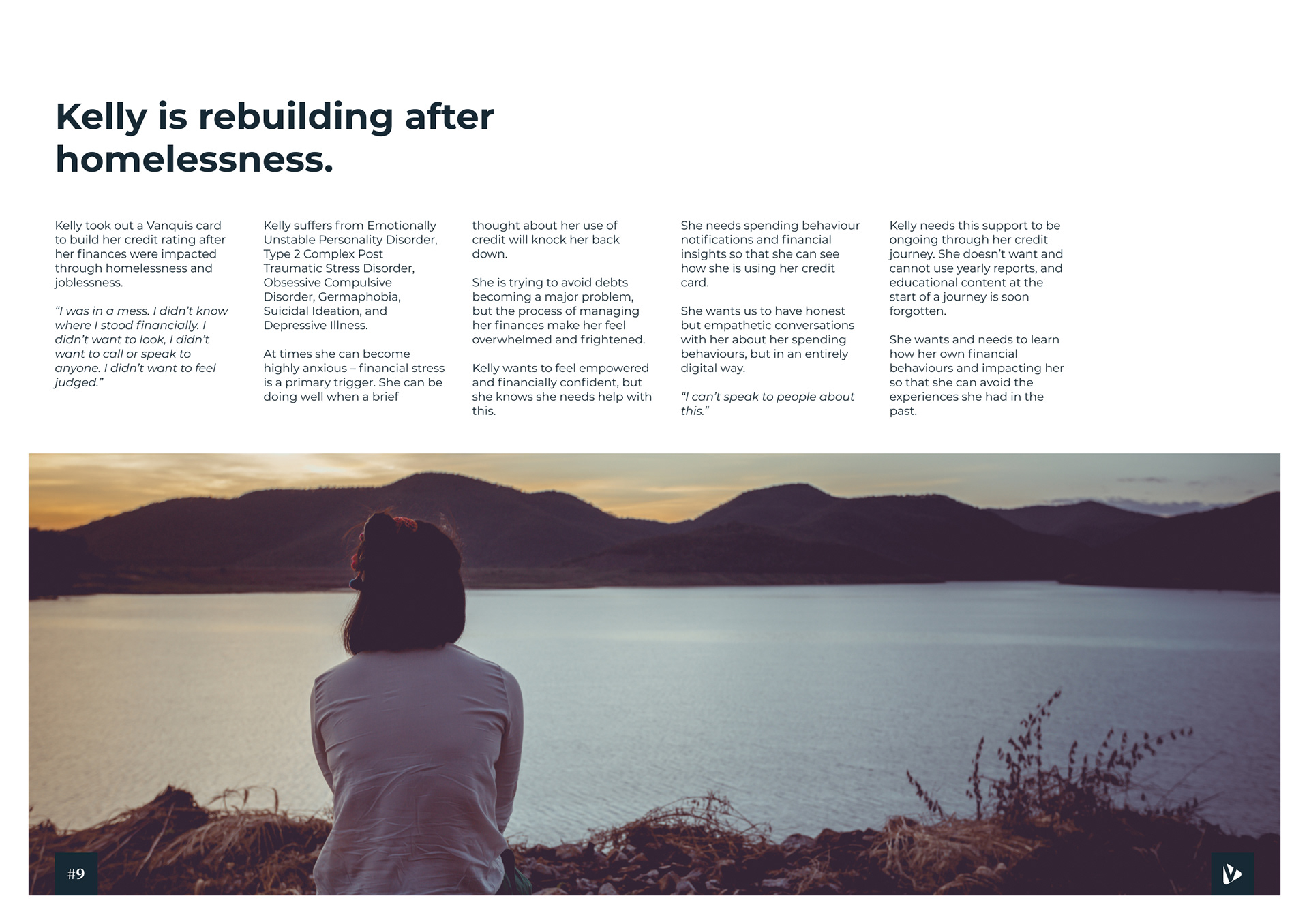

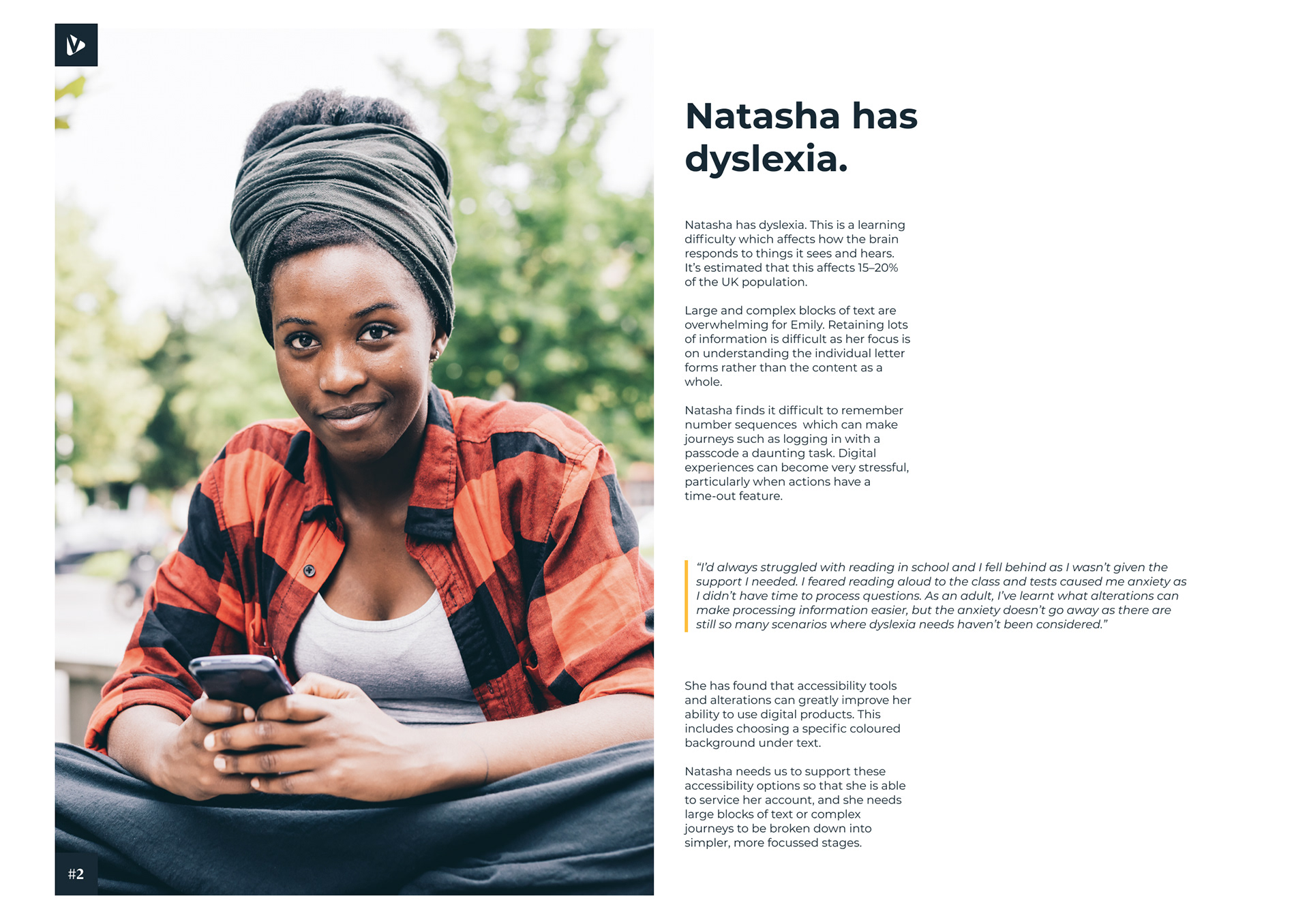

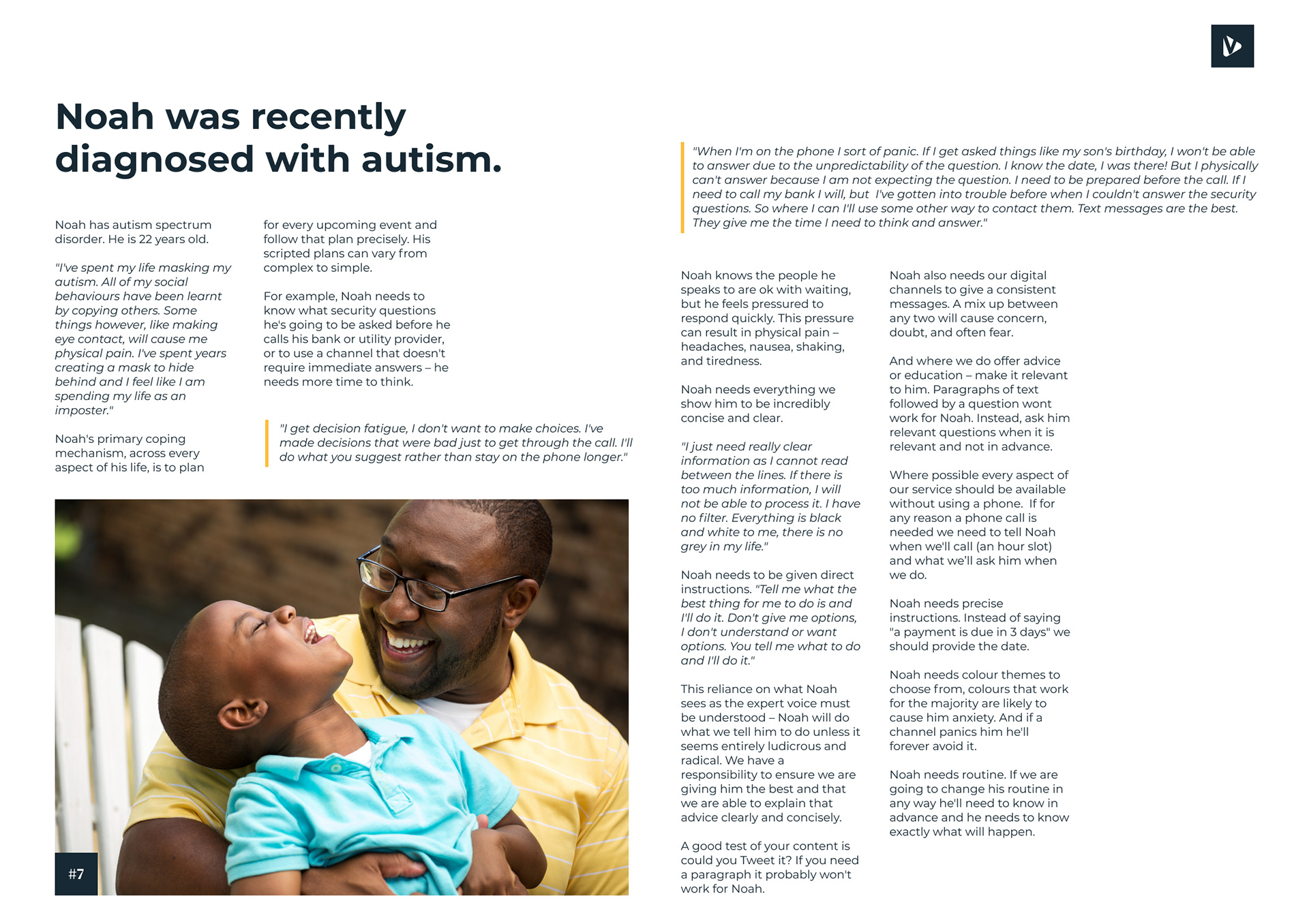

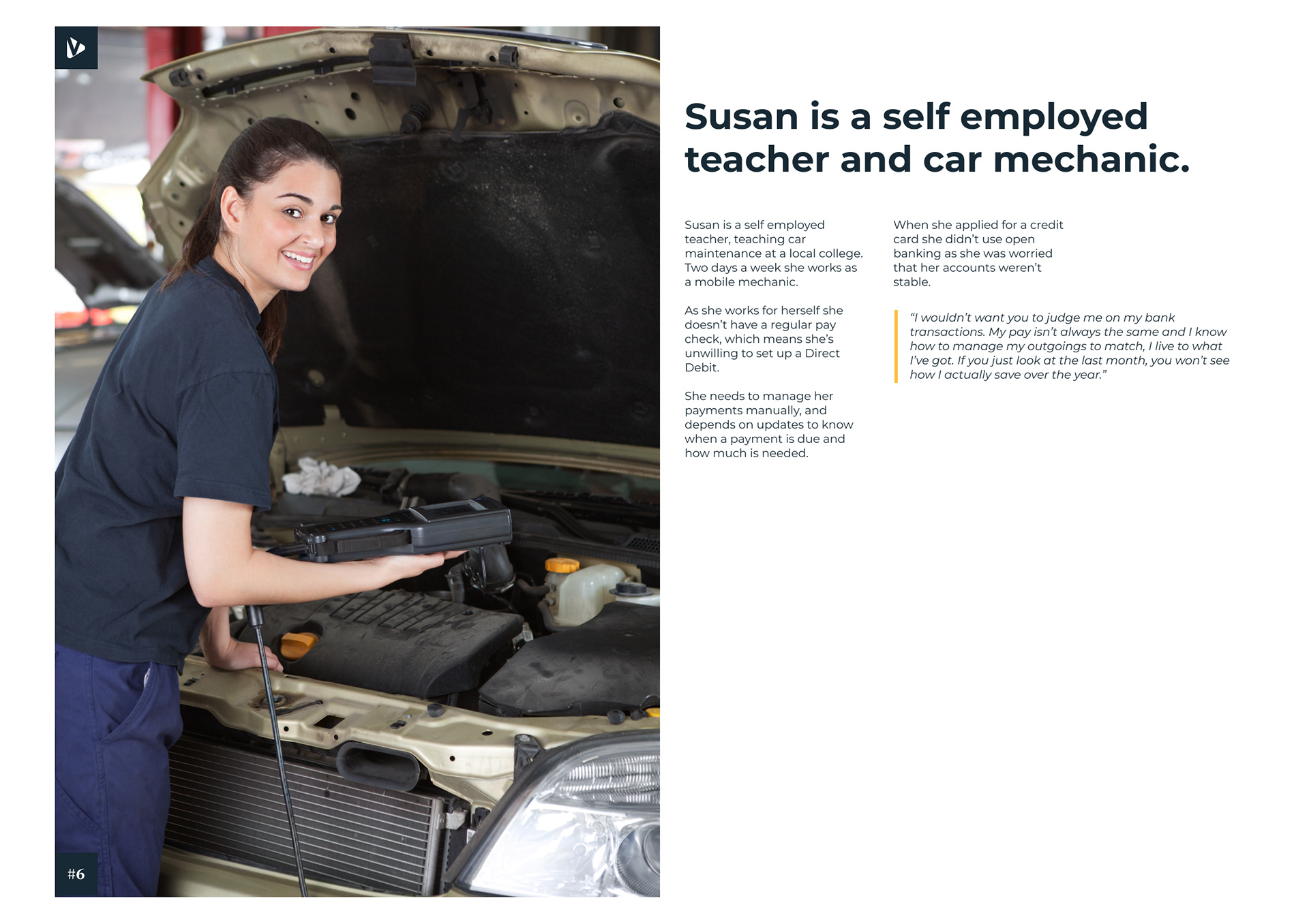

To amplify the environment of change we were building we decided to increase empathy for our customers. One way we did this was by creating tools and processes that allowed everyone to see their products as our customers do. We started with Vulnerable Customer Personas.

These are the real individual stories of some of our customers, and they exposed our colleagues to the realities of managing an account whilst living with different difficulties.

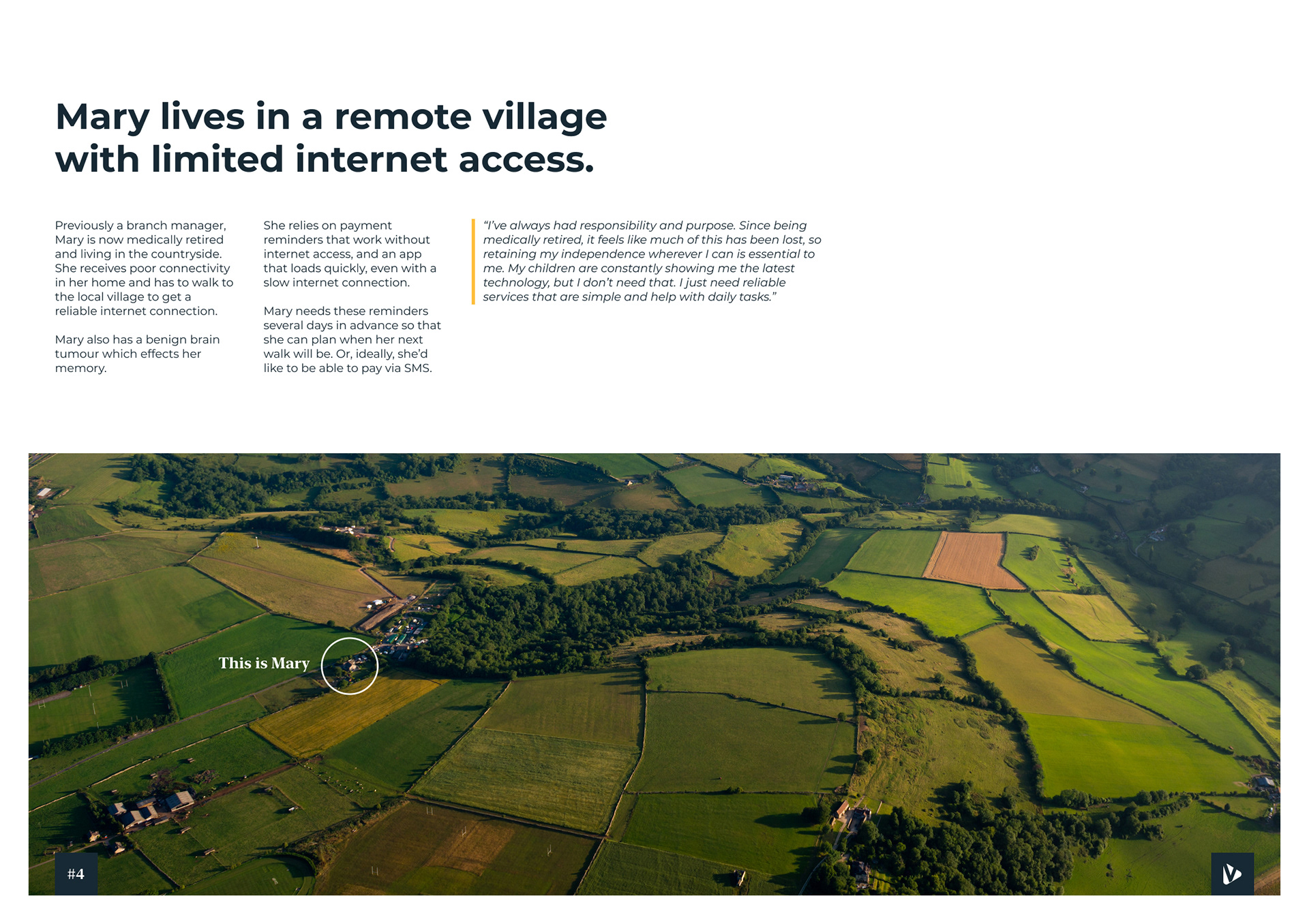

The example above is my favourite. Mary lives in an area with poor to no phone signal, and poor to no internet connectivity. She has difficulty with her memory, and as she can no longer work she receives a range of benefits. She is paying off her credit card, but isn't considered suitable for a loan as her benefits are inconsistent. This means she can't guarantee a fixed monthly payment. This leaves Mary with managing her repayments, without being able to remember they are needed, whilst living in an area where digital services cannot help her.

And so clearly, forcing Mary to use an app won't work. We need to find other ways.

When you present these stories, along with the facts and figures of customers like Mary (we have over 1,400 customers in similar situations, and between them they manage over £800,000 in personal debt), it becomes impossible to ignore. We've found that teams that were slow to act and difficult to manage prior to this work have started to become change agents for inclusive thinking.

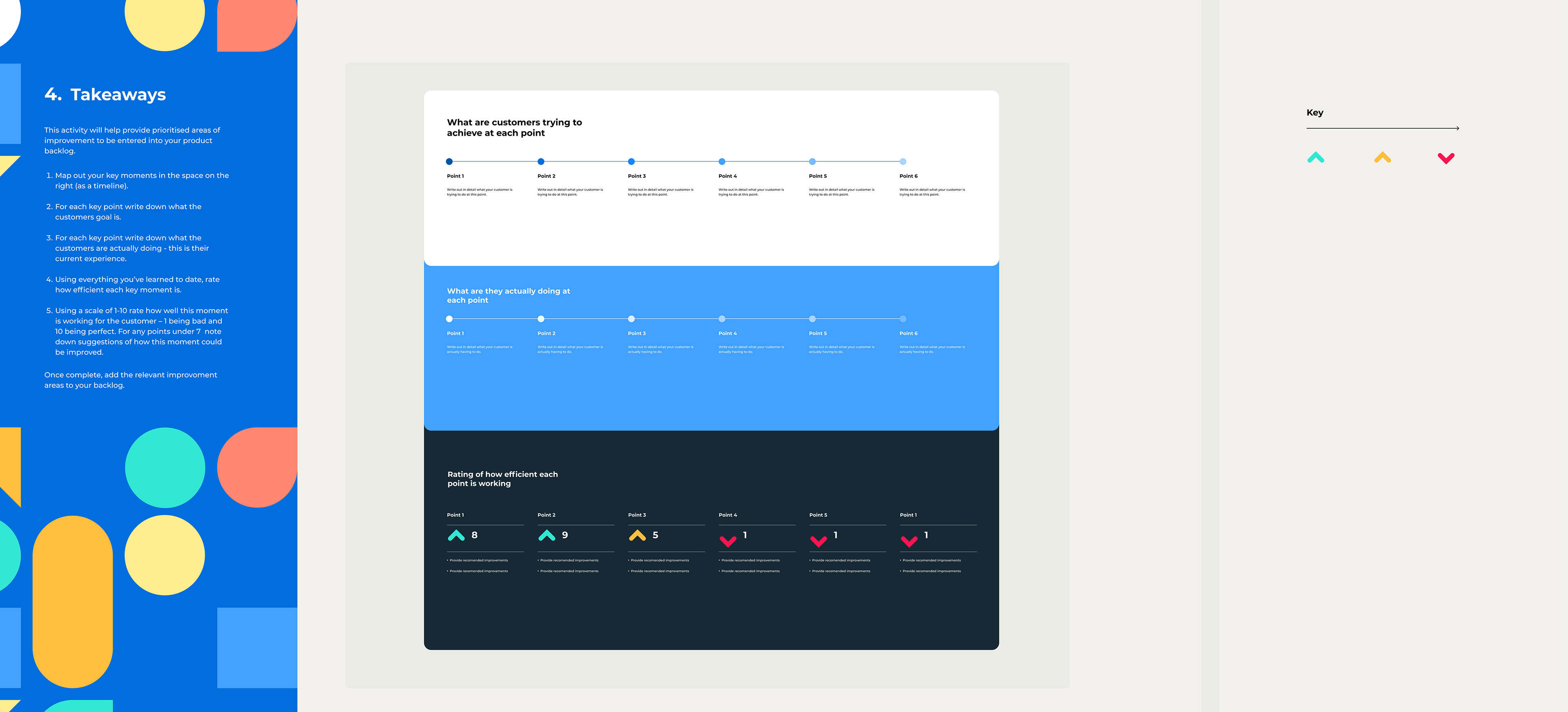

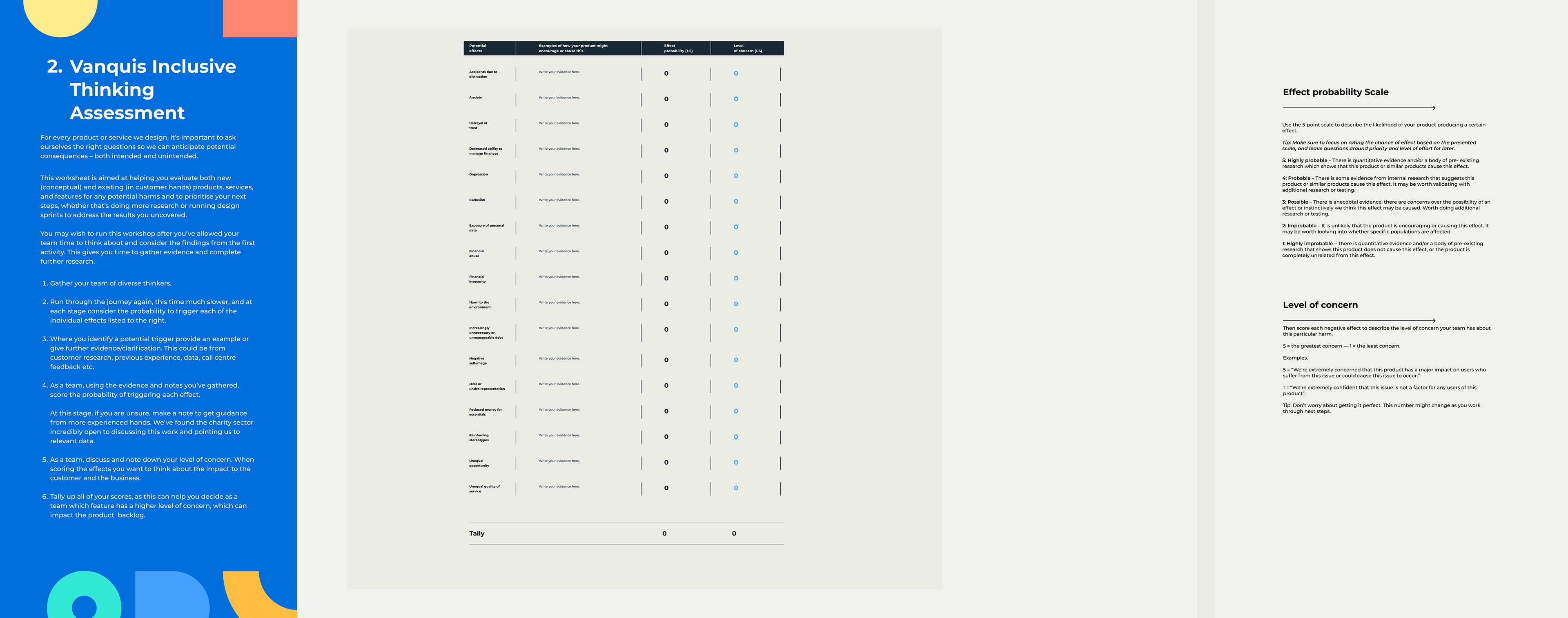

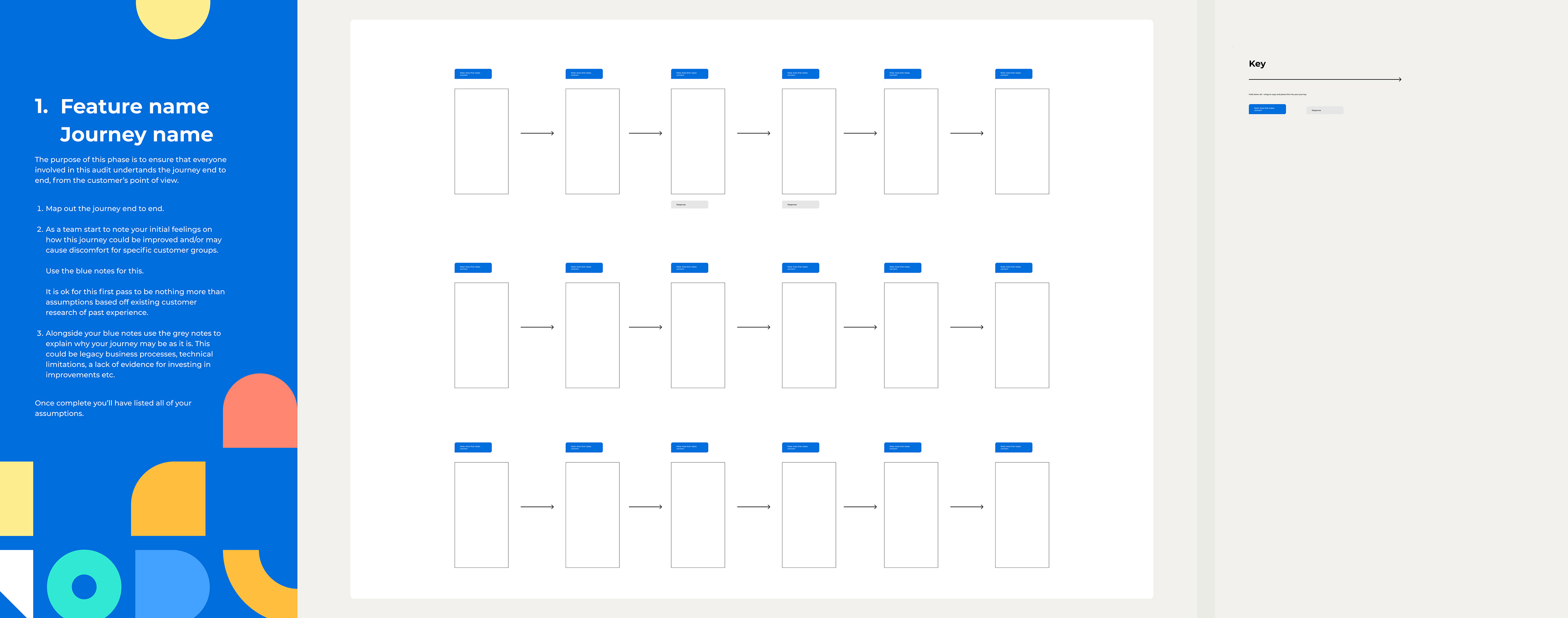

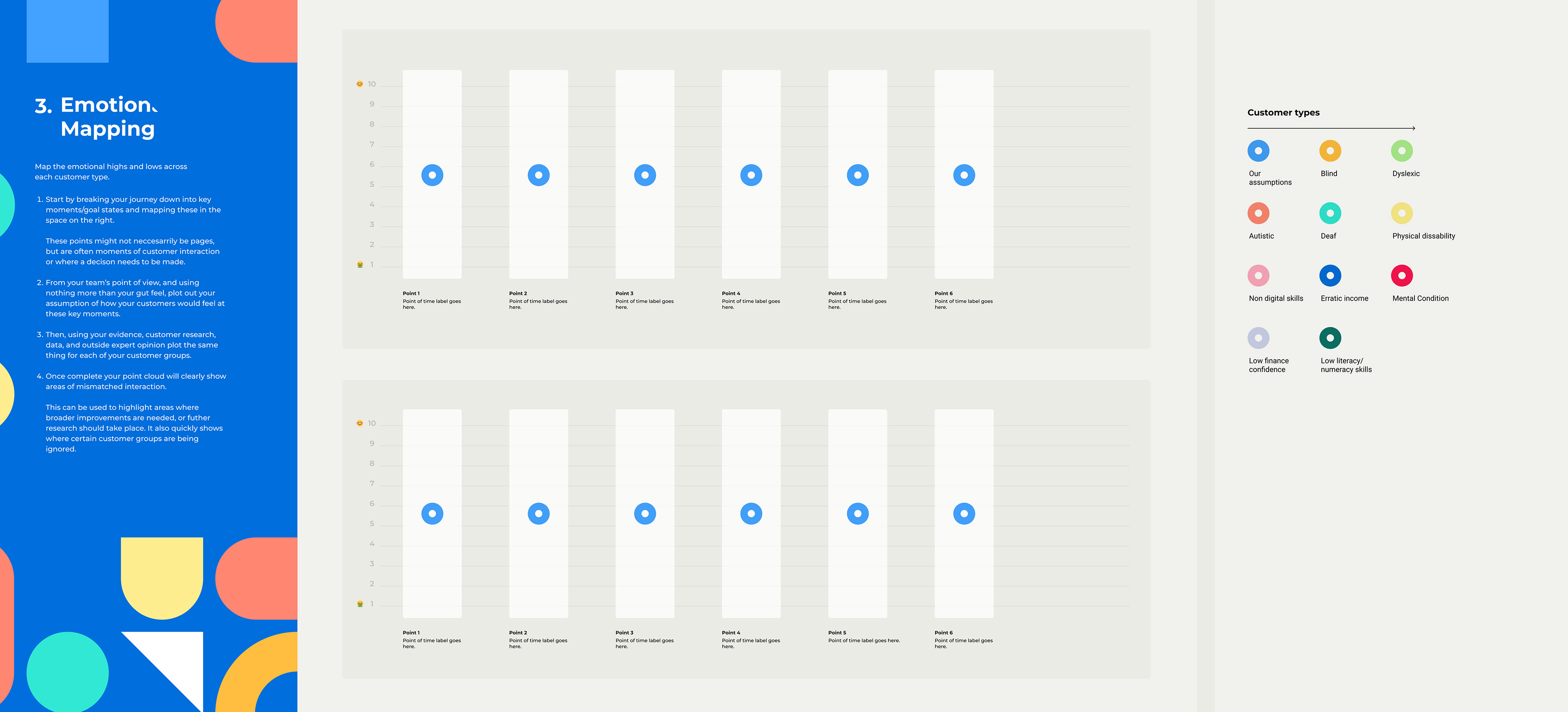

The personas are a great way to build empathy for our customers, and help to frame a difficult challenge. But they aren't enough. And so we built our Inclusive Thinking toolset. This is a set of four workshops and associated tooling that take teams through:

- the process of understanding a current offer,

- seeing it through the eyes of our customers,

- mapping where the offer may trigger more extreme reactions with vulnerable customers,

- uncovering the emotional highs and lows for different customer types as they use the feature,

- and finally distilling and prioritising the outcomes onto product backlogs.

This is design thinking led by the design team, but carried out by business teams. And the results have been astounding.

In the 6 months we've been working this way we have:

- helped the Product team to better understand how their products (credit cards, loans, etc) impact the customers daily, and start the transition to clearer and simpler forms of credit.

- helped the mobile app teams to re-imagine the customer experience and rewrite the backlogs to better reflect the needs of customers. This work has not only found large commercial opportunities but given the bank a foundation to get ahead of FCA FG21/1 Vulnerable Customer regulations.

- helped the website and application journey teams to understand the experience of applying for credit. New content standards and end to end journeys have been agreed, and new partnerships with external credit providers have been established.

- we've helped the analytics teams to marry data to customer stories, and by studying our research they've been able to codify some areas of vulnerability. This means that customers that appear credit worthy under the old models, but are actually financially vulnerable, are helped in other ways that don't expose them to credit they cannot afford.

- we've seen an increase of ~5800 accepted customers per month through basic changes to the application journey. That's a realised increase of just under £5.5 million per year.

As we transition the team away from simply "doing" design to leading it, I am taking a step back to work on the larger business strategies. Innovation, cross group design, the future of banking. Things like that.